Pursuing smart investment alternatives

Forward-thinking investors deserve smart alternatives outside the volatility of the stock market and public exchanges. Real estate may provide a solution.

More Than Just Diversification

While the real estate market can fluctuate, it has been demonstrated over time to be less volatile than some other asset classes. The potential for this stability can be a distinct advantage to investors.

Appreciation and Income

Historically, real estate investments have offered a path to wealth through property appreciation and generation of regular income. On the Realty-Income platform, we strive to offer both paths, with Private Placements and Real Estate Investment Trusts (“REITs”).

Commercial Real Estate Property Types

| Property Type | Description | Advantages & Disadvantages |

| Multifamily | Residential buildings that vary by location (urban or suburban) and may be further classified by structure: high-rise, mid-rise, or garden-style. | Economic drivers include demographic trends, home ownership, household formation rates, and local employment growth. Leases are typically short term and adjust quickly to market conditions. Generally considered to be one of the more defensive investment types within commercial real estate, though they are still subject to competitive pressures from newer construction. |

| Retail | Everything from small shopping centers, strip malls, and outlets to large power centers with a “category-dominating” anchor tenant. | Most broadly influenced by the state of the national economy generally, especially such indicators as employment growth and consumer confidence levels. More local factors include the property location and its traffic flow; population demographics; and local household incomes and buying patterns. Leases also often have long terms, which means that after a while lease rates may lag current market rates, and step ups may need to wait until lease expirations. |

| Office | Range from high-rise multi-tenant structures in city business districts to mid-rise single-tenant buildings in suburban areas. | Rents and valuations are influenced by employment growth and a region’s economic focus. Individualized tenant improvements are usually not very involved, but credit quality of tenants is key; re-leases of office space typically require some lead time to consummate. Office properties often have longer-term leases that can lag behind current market lease rates, so that significant “step-ups” or “step-downs” of rental rates may occur when leases expire. |

| Industrial | Manufacturing facilities, warehouse and distribution centers, research & development (R&D) properties and flex-space. | Manufacturing and R&D properties tend to be build-to-suit buildings that can be difficult to “re-tenant” without extensive modifications, while warehouses and distribution centers can be more generic buildings. Industrial properties are also influenced less by local job growth more than by larger economic drivers such as global trade growth (imports and exports) and corporate inventory levels. As with office buildings and retail centers, industrial property leases tend to have long terms, so that over time lease rates can fall behind “market.” |

| Other | Self-storage facilities, mobile home parks, student housing and hospitality. | Key drivers include demographic trends, the state of the national economy in general, and large macroeconomic drivers such as supply/demand. |

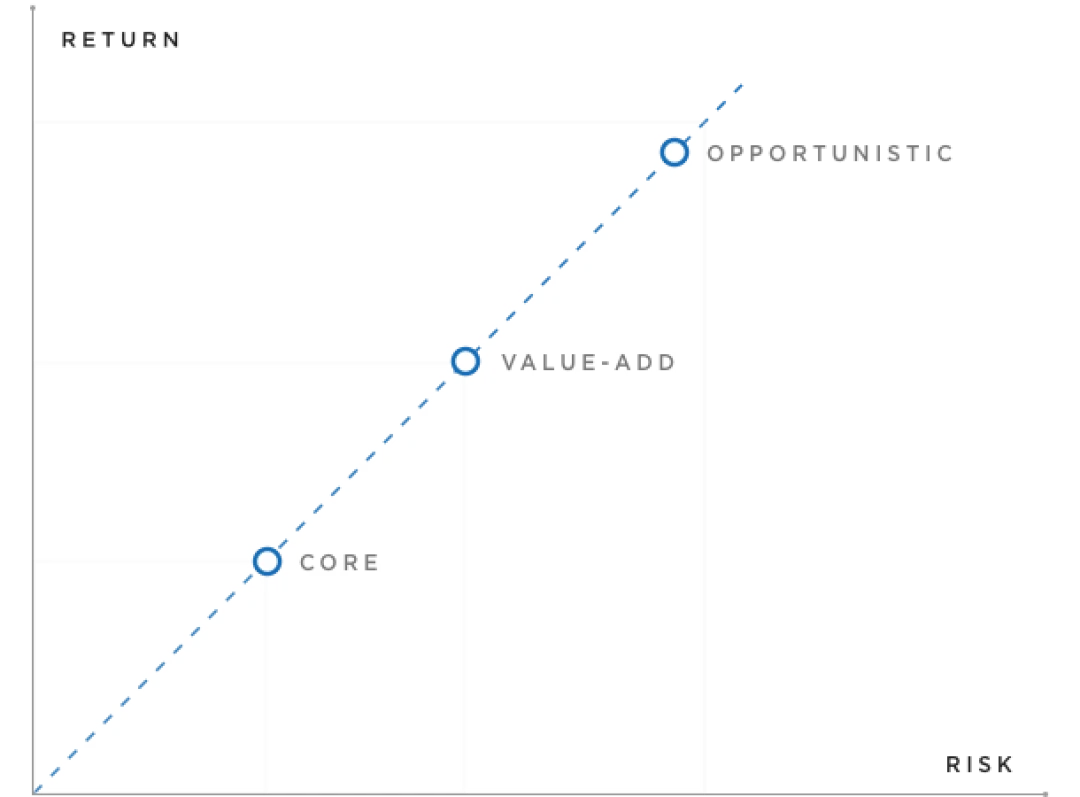

Balancing risk and return

Moving between the three primary real estate investment strategies is a bit like stepping up the ladder in terms of taking on more risk and, in theory, being compensated for that risk with higher returns.

A well-balanced commercial real estate portfolio may include some or even all of these different investment strategies.

A well-balanced commercial real estate portfolio may include some or even all of these different investment strategies.

Investment Strategies

Each of the three primary categories of real estate investment strategies has its own risk and return characteristics.

Core

Properties that are stable, fully leased, well-located and typically Class A. Lower risk and lower reward, with low leverage, if any.

Value-Add

Lower occupancy or secondary market locations with an opportunity to increase value through renovations or repositioning. Medium risk and reward with low to medium leverage.

Opportunistic

Typically raw land or ground-up development with little to no near term cash flow. High risk and high reward with high leverage.

Passive vs. Active Forms of Ownership

The way an investor owns real estate can be just as important as the underlying real estate and investment strategy. Considerations need to be made for taxes, transparency, property operations, potential tenant issues, diversification and individual financial responsibility.